Category: Cost Management

Beyond Pharmacology Alone: Integrative Soil Cultivation for Workforce Resilience

Above image: Modern industrial farming (pharmacology alone) can produce short-term results, but only as long as the constant chemical inputs continue. Stop the inputs and the plants quickly decline, because the underlying soil health was never built. Sustainable organic farming (integrative approach) cultivates rich, living soil that sustains healthy, nutrient-dense fruit even without constant intervention.

Part 4: Beyond Pharmacology Alone. Integrative Soil Cultivation for Lasting Chronic Condition Mitigation

February 20, 2026

By Humaculture, Inc.

This is the fourth in a 5-part companion series to ICSL’s analysis of post-COVID health trends and morbidity pressures.

- In Part 1, we examined the broad crisis of rising chronic conditions driving costs.

- In Part 2, we applied the Topological Model to variable-demand operations like trucking.

- In Part 3, we explored chronic surges across large workforces using actual employer data.

- Here, we build on these insights to examine why pharmacology alone falls short, and how an integrative Humaculture® Topological approach (“soil cultivation”) offers a sustainable, organic path forward.

While ICSL’s companion article, “Why GLP-1 Drugs Alone Aren’t Enough – The Case for Integrative Solutions,” highlights the limitations of a pharmacology-first mindset, Humaculture® focuses on the Organizational solution. We refine “soil” (Structure, Assets, Processes—the Organization Domain) to enable natural, lasting resilience and Created Value.

As a leader in health benefits, risk management, or workforce wellness, you’ve seen the promise of GLP-1 drugs. Impressive short-term weight loss. Better blood sugar control. Reduced cardiometabolic risks. Many hoped these medications would finally bend the curve on chronic disease burdens that drive medical claims, disability costs, and absence.

Yet the limitations have become clear: high dropout rates, substantial weight regain upon discontinuation, muscle loss, side effects, and access barriers. These issues persist because pharmacology-first approaches treat symptoms without addressing the root causes. The underlying causes (poor nutrition, sedentary lifestyle, and behavioral patterns), remain unaddressed.

The Limitation of Forcing the “Plant” with Pharmacology Alone

Many people instinctively reach for the newest pharmaceutical tool. They force the “plant” (People) toward outcomes despite depleted conditions. A pharmacology-first mindset is like painting over a mildewed wall. The problem is hidden in the short-term, but reappears quickly because the root cause was only masked. Unintended consequences emerge and natural defenses weaken over time.

GLP-1 drugs deliver impressive short-term results (Diabetes, Obesity and Metabolism 2022), but studies show discontinuation leads to rapid regain, often 50 to 100 percent of lost weight within 12 months (Rubino, JAMA 2022). Dropout rates run high, driven by side effects, cost, and access barriers (Rodriguez, JAMA 2022). Even sustained use carries risks like muscle loss (15 to 40 percent – ScienceInsights, 2025)and long-term risks (Healthhoper 2026).

Weight is just one piece of the puzzle. Elevated weight increases risk for cardiac and circulatory disease, neurological impairment, metabolic and digestive disorders, and many cancers. Yet pharmacology-first thinking treats symptoms rather than first supporting the body’s natural ability to restore health through nutrition, fitness, behavior, and prevention.

Temporary gains fade when the underlying “soil” remains poor. Short-term productivity comes at the price of sustained resilience. This mirrors trends where chronic conditions drive recurring claims, lengthened disability durations, and escalating costs.

Frustration grows as costs climb and workforce health continues to strain the business. You recognize that there must be a better way to manage our health costs. What if a more integrative approach could finally unlock the lasting resilience you’ve been seeking?

The Humaculture® Topological Model: A Practical Guide for Integrative “Cultivation”

The Humaculture® Topological Model gives leaders a clear, practical framework for this shift. It shows exactly where to refine the Organizational “soil” so People can thrive naturally and produce lasting Created Value. Three Domains interact without hierarchy:

| Domain | Challenges (Current State) | Success (Integrative Outcome) |

| Environment Domain | Rigid regulations, high drug costs, limited access to preventive care | Strong partnerships with vendors that prioritize integrative protocols and flexible plan designs |

| Organization Domain | Fragmented benefits programs, misaligned vendors, pharmacology-first defaults | Clear standards across all health, wellness, leave, disability, and workers’ compensation programs; every partner adopts integrative-first protocols (Food as Medicine, Exercise as Medicine); misaligned vendors are replaced |

| People Domain | Unaddressed personal distractions and low intrinsic motivation | Empowered, accountable Talent inclined toward health, with the tools and autonomy to perform at their best |

When leaders intentionally orchestrate these Domains through the Dynamic Matrix, the entire system becomes self-reinforcing. Resilient People produce sustainable Created Value cycle after cycle.

The Decisive Choice: Refine the “Soil” for Integrative Cultivation

Effective workplaces lay the foundation for lasting health and resilience in organizations facing chronic condition pressures. Families and Work Institute defines an effective workplace, and their research demonstrates that an effective workplace yields roughly twice-better health outcomes relative to low-effective workplaces, reducing chronic stress, fatigue-related risks, and claims severity while strengthening retention and engagement.

The turning point comes when the leader chooses intentional, integrative “cultivation” over pharmacology-first fixes. Instead of another drug-centric incentive or coverage expansion, they reallocate Assets toward merit-based Processes designed to attract and retain empowered Talent already inclined toward health. They establish clear standards and expectations across all health, wellness, leave, disability, and workers’ compensation programs and require every solution provider partner to adopt integrative-first protocols (Food as Medicine, Exercise as Medicine), ensuring full alignment and replacing any misaligned vendors that prioritize pharmacology-only approaches. Any vendor whose primary goal is adherence to prescription drug protocols is a clear red flag that they are not focused on improved health and should be replaced to ensure full alignment.

Resolution: Measurable Victory and Renewed Operations

Organizations that consistently feed the Organizational “soil” achieve balanced, lasting success. The resolution is measurable victory: higher People Health Quotient (PHQ) and Organization Healthful Quotient (OHQ), meaningful reductions in disability costs and absenteeism, stronger retention and engagement, substantially multiplied Created Value, and a renewed operation ready for the next cycle. Just as organic gardening produces fruit with significantly higher nutrient density, integrative health solutions is like “soil” cultivation (Organization Domain refinement) that yields resilient People who deliver superior, sustainable outcomes.

For leaders facing chronic condition pressures, the results include:

- Economic. Strong multi-dollar returns on investment. Meaningful reductions in medical and prescription drug spending, disability costs, and indirect disruptions. Easier recruiting of ideal Talent. Reduced turnover. Fewer recurring claims. Recovered productivity that directly protects financial stability.

- Effectual. Tangible risk reduction. Lower chronic disease progression. Decreased utilization severity. Faster recovery from health events. Measurable declines in the key post-COVID morbidity drivers.

- Emotional. Authentic resonance through merit-based recognition, constructive challenge, and mission alignment. This builds voluntary engagement and retention rather than dependency or resentment.

The outcome is multiplied Created Value. Higher retention. More productive teams. More stable operations. Reduced absenteeism and disruptions. The organization becomes self-reinforcing. Resilient People produce sustainable Created Value (“fruit”) cycle after cycle.

Next up, in Part 5, we’ll examine partnering to address chronic risk at scale. Companion to ICSL’s focused analysis.

Take the First Step

As a starting point, contact Humaculture® for a review of your medical, disability, workers’ compensation, and absenteeism data, mapped to the Dynamic Matrix. We’ll identify leverage points to cultivate resilience and Created Value in your unique terrain.

Read the companion ICSL article for the full view of why pharmacology alone isn’t enough. Join us in building organizations where People don’t just manage chronic risk. They flourish despite it.

Contact: Steve Cyboran at [email protected], Wes Rogers at [email protected], or Caroline Cyboran at [email protected]

Website: humaculture.com

LinkedIn: humaculture-inc

Humaculture® — Cultivate Organizations, Grow People.

Chronic Condition Surges in the Workforce: Refining “Soil” Resilience

Part 3: Chronic Condition Surges and Workforce Impacts. Refining Organizational “Soil” for Population Resilience

February 5, 2026

By Humaculture, Inc.

This is the third in a 5-part companion series to ICSL’s analysis of post-COVID health trends and morbidity pressures. In Part 1, we examined the broad crisis of rising chronic conditions driving costs across insurance and benefits programs. In Part 2, we applied the Topological Model to variable-demand operations like trucking, where isolation, sedentary work, and limited nutrition access make health risks hit harder. Here, we focus on real employer impacts—drawing from anonymized client data and industry trends to show chronic condition surges in the workforce—and how the Dynamic Matrix helps you diagnose your unique terrain and refine your “soil” for lasting results.

While ICSL’s article, “Real Employer Impacts – Post-COVID Disability and Cost Surges,” illuminates the clinical and industry realities deepening in 2025, Humaculture® offers the organizational framework for sustainable solutions. We refine Organizational “soil” (Structure, Assets, Processes) so People naturally thrive and produce Created Value.

You’ve worked hard to build a strong team, developing competitive benefits, wellness incentives, and support programs. You’ve done the things leaders do to keep people healthy and productive. But lately, something’s different. Chronic condition surges in the workforce are shifting the landscape. Disability claims are up sharply. Medical costs are climbing. Absence is dragging on performance. The pressure is real, and it’s hitting the workforce you’ve helped develop.

When Traditional Approaches Could Only Slow the Surge

You’ve tried the usual tools, such as expanded EAPs, provided more generous return-to-work programs, broader coverage, bigger incentives. They helped: some claims slowed, some people returned faster, but the surge kept going. Recurring issues lengthened overall durations. Underlying health problems didn’t go away. Frustration set in as the team you’ve built started to feel the strain.

A Diagnostic Path Emerges

That’s when curiosity turned toward a different approach. ICSL showed a better way: early identification, nutrition and fitness focus, behavioral support, integrative strategies. By diagnosing the root drivers behind disability and cost surges, ICSL acts like a “soil” test for your garden. It reveals what’s really wrong so you can fix it right.

Industry-wide data confirms the scale. The number of people with disabilities in the U.S. labor force (in thousands) rose sharply after 2020 and has continues to rise (FRED data). This isn’t an isolated problem. It’s widespread and persistent, touching organizations everywhere.

The Humaculture® Topological Model: A Mentor for Diagnosing and Refining Large Workforces

The Humaculture® Topological Model provides a proven framework. Three Domains interact fluidly without hierarchy to foster purposeful Value Creation. The Dynamic Matrix provides profound insights into the connections (topology) between them. It lets you see leverage points and unintended consequences before problems escalate.

The cultivated “soil” is the Organization Domain (Structure, Assets, and Processes) that enables the “plants” (People) to thrive within the broader terrain (Environment).

- Environment Domain. The broader terrain. Rules (benefits regulations, labor laws), Natural Resources (health plan budgets, vendor networks), Community (employees, unions, regulators, potential employees).

- Challenges: Post-COVID morbidity surge, rising claims across large populations, regulatory constraints on incentives.

- Opportunities: Align external conditions with internal resilience through data-driven plan design and vendor partnerships for preventive support.

- Organization Domain. The cultivated “soil”. Structure (flat governance, administrative hierarchies), Assets (financial reserves, technology platforms), Processes (Leadership and Operational).

- Challenges: Recurring claims lengthening durations, administrative delays, inconsistent support for chronic conditions.

- Opportunities: Reliable execution of these Processes creates a well-functioning operation where people rely on consistent support, fair accommodations, and financial stability.

- People Domain. The “plants”. Personal Characteristics (age, gender, height, weight, behavioral heuristics such as empowerment vs. entitlement focus), Skills/Training/Education/Experiences (health literacy, chronic condition self-management), Created Value (productivity, engagement, service delivery).

- Challenges: Sustained chronic utilization, recurring disability, absenteeism from unmanaged conditions.

- Opportunities: Refined “soil” enables people to manage chronic risks without overload, producing resilient, healthy, productive Talent.

The Decisive Choice: Refine the “Soil”

Think of your workforce like a garden of tomatoes. Some “plants” are struggling: wilted leaves, poor yield. Is it missing nutrients? Too much water? Bad drainage? Variable weather? ICSL screenings are the “soil” test, showing exactly what’s off. The Humaculture® Topological Model helps you refine the “soil” based on that diagnosis to attract and retain the right “plants” that will thrive in the improved conditions.

In large workforces facing chronic condition surges, effective workplaces don’t just happen. They require intentional orchestration of the Dynamic Matrix with meaningful challenge through purposeful work, responsive supervisor support, autonomy over aspects of the job, co-worker backing through peer networks, respect for contributions, work-life fit with predictable recovery time, adequate pay, and opportunity for advancement. Research from the Families and Work Institute shows such workplaces yield roughly twice-better health outcomes relative to low-effective workplaces, reducing chronic stress, fatigue-related risks, and claims severity while strengthening retention and engagement.

The turning point is when you decide to refine the “soil” intentionally. Instead of another generic program or incentive tweak, reallocate Assets toward merit-based Processes, embed practical biometric feedback in Performance Nurturing, adjust benefits administration through Resource Allocation, align Cultural Nurturing with mission and independence, and build peer networks and mentorship to foster belonging and support.

Client data shows this works. Integrative health support improved biometric measures and reduced claims and employee costs year-over-year. In another organization, refined Processes reduced unscheduled absence by 60%. These structures activate within Cultural Nurturing and Community Engagement, helping People connect and become resilient despite ongoing pressures.

Brief daily routines with high adherence have been shown to substantially reduce pain levels and support sustained focus and productivity. Deeply integrated workplace resilience programs focused on empowerment, including coaching for lifestyle, fitness, nutrition, and gut/digestive health, deliver strong returns on investment when designed within a broader initiative. A shift in focus toward merit, health, and empowerment can also attract and retain Talent already inclined toward health and productivity. These yield meaningful improvements in chronic disease risk factors, reductions in symptom burden, and corresponding lower medical spending and claims severity, addressing widespread post-COVID morbidity. Embedded support for health-related absences, when part of broader resilience Processes, significantly shortens disability durations tied to chronic conditions, producing high ROI.

HARS™ (Health, Absence, Resilience Support) is a sub-knowledge set within the Topological Model. It specifically addresses, analyzes, and predicts Process improvements to achieve the Three Promises in health, absence, and resilience areas.

Resolution: Measurable Victory and Renewed Operations

Organizations that consistently feed the Organizational “soil” achieve balanced, lasting success. The resolution is measurable victory: higher People Health Quotient (PHQ) and Organization Healthful Quotient (OHQ), meaningful reductions in disability costs and absence, stronger retention and engagement, substantially multiplied Created Value, and a renewed operation ready for the next cycle.

For leaders managing large workforces facing chronic condition surges, the results include:

- Economic. Strong multi-dollar returns on investment. Meaningful reductions in medical spending, disability costs, and indirect disruptions. Easier recruiting of ideal Talent, reduced turnover, fewer recurring claims, and recovered productivity that directly protects financial stability.

- Effectual. Tangible risk reduction, lower chronic disease progression, decreased utilization severity, faster recovery from health events, and measurable declines in the key post-COVID morbidity drivers.

- Emotional. Authentic resonance through merit-based recognition, constructive challenge, and mission alignment. This builds voluntary engagement and retention rather than dependency or resentment.

The outcome is multiplied Created Value, with Higher retention, more productive teams, more stable operations, reduced absenteeism and disruptions. The organization becomes self-reinforcing. Resilient People produce sustainable fruit cycle after cycle.

Next week, in Part 4, we’ll examine why pharmacology alone isn’t enough. Companion to ICSL’s focused analysis.

Take the First Step

As a starting point, contact Humaculture® for a review of your medical, disability, workers’ compensation, and absenteeism data. We’ll identify leverage points to cultivate resilience and Created Value in your unique terrain.

Read the companion ICSL article for the full view of employer impacts: https://www.linkedin.com/pulse/real-employer-impacts-post-covid-disability-9ndme. Join us in building organizations where People don’t just manage chronic risk. They flourish despite it.

Contact: Steve Cyboran at [email protected], Wes Rogers at [email protected], or Caroline Cyboran at [email protected]

LinkedIn: humaculture-inc

Humaculture® — Cultivate Organizations, Grow People.

Chronic Health Risks in Trucking: Cultivating Soil Resilience in Variable-Demand Operations

Part 2: Chronic Health Risks in Variable-Demand Operations. Cultivating Soil Resilience in Trucking and Beyond

January 29, 2026

By Humaculture, Inc.

This is the second in a 5-part companion series to ICSL’s analysis of post-COVID health trends and morbidity pressures. In Part 1, we explored how cultivating Organizational “soil” addresses rising chronic conditions across insurance and benefits programs. Here, we apply that framework to variable-demand operations—trucking, bus driving, construction equipment, forklifts, warehouse management, order picking, and similar roles—where the challenge of chronic health risks has been exacerbated.

While ICSL’s companion article, “Trucking Industry Health Crisis – Driver Deaths, Shortages, and Safety Risks,” diagnoses the clinical realities in trucking, Humaculture® focuses on the Organizational solution. We enrich “soil” (Structure, Assets, Processes—the Organization Domain) to build resilient People who thrive and produce Created Value.

As a leader in transportation and logistics, you know the operation runs on reliable People. Drivers who deliver. Warehouse managers who coordinate. Forklift operators who load. Order pickers who fulfill. Yet chronic health risks in trucking and variable-demand roles have exacerbated a manageable challenge into a critical bottleneck. Driver deaths. Persistent shortages. Rising accident severity. Workforce disruptions that ripple through service, safety, and costs.

Traditional responses proved insufficient. Higher pay. Recruiting bonuses. Stricter safety protocols. They slowed the decline but could not stop it. Retention stayed difficult. Accidents persisted. Frustration grew as the operation you built began to strain under health-related exits and disruptions.

But what if the most powerful leverage point lies in the Organizational “soil” that shapes resilience in variable-demand conditions?

The Limitation of Forcing the “Plant” Amid Chronic Health Risks in Trucking

Many operations instinctively reach for direct incentives or stricter rules. They force the “plant” (People) to perform despite irregular schedules, long hours alone, limited healthy food options, and sedentary demands. Generic wellness programs, often delivered through yet another standalone app that adds to fatigue, yield modest results at best. Research shows that less-integrated initiatives quickly lose adherence when they conflict with real-world demands. Brief, embedded routines, by contrast, maintain strong participation and deliver meaningful outcomes.

Temporary periods of constructive challenge can build deeper resilience. Think of focused intensity during peak seasons. Much like a seasonal drought prompts roots to grow stronger and access deeper nutrients. When balanced with adequate recovery, these challenges foster long-term adaptability and strength.

Chronic overload tells a different story. Unrelenting irregular hours without sufficient recovery turn constructive stress into toxic overload. The cost is clear. Elevated burnout. Health deterioration. Depleted long-term resilience. Short-term miles come at the price of sustained safety and retention. This mirrors the trends where chronic conditions drive higher disability, deaths, and crash severity.

The difference lies in consistently feeding the “soil”. We refine Processes to enable natural, sustainable growth.

The Humaculture® Topological Model: A Mentor for Sustainable Cultivation in Variable-Demand Operations

The Humaculture® Topological Model provides leaders with a proven framework. Three Domains interact fluidly without hierarchy to foster purposeful Value Creation. The Dynamic Matrix provides profound insights into the connections (topology) between them.

The cultivated “soil” is the Organization Domain—Structure, Assets, and Processes—that enables the “plants” (People) to thrive within the broader terrain (Environment).

Environment Domain

The broader terrain. Rules (hours-of-service regulations, safety standards), Natural Resources (fuel, equipment, rest facilities, capital for investment), Community (customers, regulators, potential employees).

- Challenges: Constant regulatory adaptation, variable fuel costs, customer pressure for speed, limited healthy food options at rest stops.

- Opportunities: Align external conditions with internal resilience through better rest planning, safety compliance, and partnerships among peer Organizations and vendors to improve access to nutritious food options.

Organization Domain

The cultivated “soil”. Structure (flat governance, route planning hierarchies), Assets (trucks, technology, financial reserves), Processes (Leadership and Operational). Leadership Processes set direction and norms: Strategic Planning aligns long-term routes with health needs; Resource Allocation funds reliable scheduling, equipment, and family-supportive benefits; Skill Development builds advanced safety and fatigue-management capabilities; Community Engagement incorporates customer feedback for realistic timelines; Cultural Nurturing fosters respect and mission resonance; Performance Nurturing provides feedback on routes and well-being. Operational Processes execute day-to-day reliability: predictable dispatching, payroll accuracy, maintenance schedules, compliance workflows, and administrative support for leave or family needs.

- Challenges: Irregular hours, equipment downtime, administrative delays, sedentary lifestyle demands.

- Opportunities: Reliable execution of these Processes creates a well-functioning operation where People rely on consistent management support, fair schedules, and financial stability.

People Domain

The “plants”. Personal Characteristics (age, gender, height, weight, behavioral heuristic), Skills/Training/Education/Experiences (CDL certification, HAZMAT training, Supply Chain Warehousing Certificate), Created Value (safe deliveries, on-time performance, customer satisfaction).

- Challenges: Isolation, sedentary lifestyle, poor nutrition access.

- Opportunities: Refined “soil” enables People to manage variability without chronic overload, producing resilient, healthy, productive Talent.

In variable-demand operations like trucking, effective workplaces do not emerge by accident. They require intentional orchestration of the Dynamic Matrix—meaningful challenge through purposeful work, responsive supervisor support, autonomy over aspects of tasks, co-worker backing through peer networks, respect for contributions, work-life fit with predictable recovery time, fair pay and advancement paths. Research from the Families and Work Institute shows such workplaces yield roughly twice-better health outcomes relative to low-effective workplaces, reducing chronic stress, fatigue-related risks, and claims severity while strengthening retention and safety.

The Decisive Choice: Refine the “Soil”

The turning point comes when the leader chooses intentional cultivation over leaving the Dynamic Matrix uncoordinated. Instead of another bonus program or compliance rule, they reallocate Assets toward merit-based Processes. They embed practical biometric feedback in Performance Nurturing. Adjust scheduling safeguards through Resource Allocation. Align Cultural Nurturing with mission and independence. Foster peer networks and mentorship to build belonging and support.

Published examples show this works. J.B. Hunt fosters belonging through driver appreciation events. Swift Transportation Mentor Program has experienced drivers mentor new ones on real-world skills, safety, and adaptation – focusing on performance improvement and retention through direct peer guidance. PAM Transport Driver Mentor Program allows mentors to earn extra pay while guiding new drivers on routes, safety, and lifestyle management – delivering practical, incentive-driven peer support for job success and resilience. Averitt Express provides paid training with personal driver trainers (experienced peers) for onboarding and skill development, supporting reliability and peer learning. Schneider’s Driver Ambassadors, selected for excellence, advocate improvements to the driver experience. Opportunities remain to develop virtual networks and revive depot meetups, creating informal communities that combat isolation and provide practical co-worker support for job success. These structures activate within Cultural Nurturing and Community Engagement, helping People feel connected despite the road.

Brief daily routines with high adherence have been shown to substantially reduce pain levels and support sustained focus—countering sedentary demands. Deeply integrated workplace resilience programs, including preventive coaching for lifestyle, nutrition, and gut/digestive health, deliver strong multi-dollar returns on investment when designed to attract and retain Talent already inclined toward health. These yield meaningful improvements in chronic disease risk factors, reductions in symptom burden, and corresponding lower medical spending and claims severity—addressing limited healthy food options on the road. Embedded support for health-related absences, when part of broader resilience Processes, significantly shortens disability durations tied to chronic conditions, producing high ROI.

HARS™ (Health, Absence, Resilience Support) is a sub-knowledge set within the Topological Model. It specifically addresses, analyzes, and predicts Process improvements to achieve the Three Promises in health, absence, and resilience areas.

Resolution: Measurable Victory and Renewed Operations

Organizations that consistently feed the Organizational “soil” achieve balanced, lasting success. The resolution is measurable victory: higher People Health Quotient (PHQ) and Organization Health Quotient (OHQ), meaningful reductions in disability costs and absenteeism, stronger retention and engagement, substantially multiplied Created Value, and a renewed operation ready for the next cycle.

For leaders in transportation and logistics facing chronic health risks in trucking, the results include:

- Economic. Strong multi-dollar returns on investment. Meaningful reductions in medical spending, disability costs, insurance premiums, and indirect disruptions. Easier recruiting of ideal drivers. Reduced turnover. More drivers passing DOT health examinations. Fewer safety incidents. This results in recovered productivity that directly protects operational stability.

- Effectual. Tangible risk reduction. Lower chronic disease progression. Decreased accident severity. Faster recovery from health events. This supports measurable declines in the key post-COVID morbidity drivers.

- Emotional. Authentic resonance through merit-based recognition, constructive challenge, and mission alignment. This builds voluntary engagement and retention rather than dependency or resentment.

The outcome is multiplied Created Value. Higher retention. Safer miles. More stable operations. Reduced shortages and disruptions. The operation becomes self-reinforcing. Resilient People produce sustainable fruit cycle after cycle.

Next week, in Part 3, we’ll examine chronic condition surges and broader workforce impacts. Companion to ICSL’s focused analysis.

Take the First Step

As a starting point, contact Humaculture® for a review of your medical, disability, workers’ compensation, and absenteeism data, mapped to the Dynamic Matrix. We’ll identify leverage points to cultivate resilience and Created Value in your unique terrain.

Read the companion ICSL article for the full view of trucking challenges. Join us in building operations where People don’t just endure variability. They flourish within it.

Contact us if you would like to learn more or have your data analyzed.

LinkedIn: humaculture-inc

Humaculture® — Cultivate Organizations, Grow People.

Cultivating Resilience: Organizational “Soil” Health in an Era of Chronic Risk

Above Image: Bent by winds, unbroken by storms. Holistically addressing chronic health condition costs.

Part 1: Rising Chronic Health Conditions Costs – Feeding Organizational “Soil” to Build Sustainable Resilience

January 22, 2026

By Steve Cyboran, Humaculture, Inc.

This is the first in a 5-part companion series to ICSL’s analysis of post-pandemic mortality and morbidity trends driving chronic health conditions costs. While ICSL illuminates the clinical and industry pressures deepening in 2025, Humaculture® offers the organizational framework for sustainable solutions—cultivating resilient “soil” (Structure, Assets, Processes) so People naturally thrive and produce Created Value.

As a leader of an insurance organization or an employer-sponsored benefits program, you are navigating an era where chronic health risks have moved from background concern to the primary driver of escalating costs. Throughout 2025, the burdens of chronic health conditions costs were unrelenting. Rising medical claims and stop-loss events. Prolonged disability durations. Increased accident severity. Elevated absenteeism and presenteeism. Workforce disruptions, customer service gaps, and lost productivity. As detailed in the companion analysis from ICSL, “The Insurance Crisis Deepens – 2025 Earnings and Chronic Disease Pressures,” the root drivers trace to five persistent post-COVID categories (Cardiac & Circulatory, Nervous & Neurological, Metabolic & Digestive, Cancer, and External causes) that continue to elevate morbidity, utilization, and both direct and indirect costs.

Traditional responses proved insufficient. Rate increases. Benefit restrictions. Siloed wellness apps. They treated symptoms while the underlying conditions persisted. Leaders felt the frustration. Short-term fixes delivered diminishing returns. Talent retention suffered under chronic stress. Created Value eroded as health-related disruptions compounded.

But what if the most powerful leverage point lies not in the claims data alone, but in the organizational “soil” that shapes human resilience day after day?

The Escalating Chronic Health Conditions Costs

The chronic health conditions costs employers and insurers face are not just financial. They disrupt service delivery, safety, and stability. Many organizations instinctively reach for direct incentives or punitive measures, which essentially attempts to force the “plant” (People) to perform despite less than ideal conditions. Generic wellness programs, often delivered through yet another standalone app that adds to employee fatigue, yield modest results at best. Research shows that less-integrated initiatives quickly lose adherence when they conflict with daily workflow. Brief, embedded routines maintain strong participation and deliver meaningful outcomes.

Temporary periods of constructive challenge (such as focused, time-bound intensity during critical projects) can build deeper resilience, much like a seasonal drought prompts roots to grow stronger and access deeper nutrients. When balanced with adequate recovery, these challenges foster long-term adaptability and strength.

In contrast, chronic extreme hours (unrelenting demands without sufficient recovery) turn constructive stress into toxic overload. The cost is clear: elevated burnout, family incompatibility, and depleted long-term resilience. Short-term gains come at the price of sustained health, mirroring the trends where delayed screenings and chronic stressors drive higher claims severity and indirect costs.

The difference lies in consistently feeding the “soil” – enriching Processes to enable natural, sustainable growth.

The Humaculture® Topological Model: A Mentor for Sustainable Cultivation

The Humaculture® Topological Model provides leaders with a proven framework. The Dynamic Matrix. Three Domains (Environment, Organization, People) interact fluidly without hierarchy to foster purposeful Value Creation.

- Environment Domain: The broader terrain (Rules, Natural Resources, Community) that sets external conditions.

- Organization Domain: The cultivated “soil” – Structure (governance, workflows), Assets (financial, physical, intangible), and Processes (Strategic Planning, Resource Allocation, Skill Development, Community Engagement, Cultural Nurturing, Performance Nurturing).

- People Domain: The “plants” – Personal Characteristics, Skills/Training/Education/Experiences, and Created Value (innovation, productivity, service delivery).

Processes are the enabling layer that turns resources into sustained growth. Performance Nurturing, for example, addresses four Areas of Focus – Knowing (what to do), Wanting (motivation), Ability (removing barriers), and Capacity (bandwidth) – to drive lasting behavior change. When purposefully designed and resourced, these Processes nurture Well-being (health and resilience) as the precursor to abundant Created Value.

In the context of today’s chronic risk pressures, this means shifting from reactive cost management to proactive “soil” enrichment:

- Brief daily routines with high adherence have been shown to substantially reduce disability days and pain levels.

- Deeply integrated workplace resilience programs, with strong leadership, resonating strategy, support to empower behavior change, and aligned workplace policies, deliver strong multi-dollar returns on investment, with meaningful improvements in health, reductions in absenteeism, and corresponding lower medical spending and claims severity.

- Optimized return-to-work support, when embedded in broader resilience Processes, significantly shortens disability durations, producing high ROI.

HARS™ (Health, Absence, Resilience Support) operationalizes this within the Matrix. It substantially reduces short-term disability and workers’ compensation duration and delivers measurable outcomes across health, absence, and productivity.

The Decisive Choice: Enrich the “Soil”

The turning point comes when the leader chooses cultivation over coercion. Instead of another benefit restriction or standalone initiative, they reallocate Assets toward merit-based Processes: embedding early biometric feedback in Performance Nurturing, flattening unnecessary hierarchy for faster decision cycles, and aligning Cultural Nurturing with mission resonance.

This is not entitlement. It is Equality of Opportunity. Well-tended “soil allows resilient Talent to thrive according to their ability to utilize the conditions provided.

The Resolution: The Three Promises Delivered. Starting with Economic Viability

Organizations that consistently feed the organizational “soil” achieve balanced, lasting success. For leaders managing benefits programs or insurance risk in today’s environment, the results begin with a clear Economic payoff with substantial containment of chronic health conditions costs:

- Economic: Defensible, actuarial-grade ROI. Comprehensive, deeply embedded resilience programs deliver strong multi-dollar returns on investment, with meaningful reductions in absenteeism, medical spending, disability costs, and indirect disruptions. Leaders often see meaningful improvements in employee resilience leading to corresponding reductions in medical costs, fewer catastrophic events, reduced workforce turnover, and recovered productivity that directly protects financial stability.

This economic viability is sustained and amplified by the other two promises:

- Effectual: Tangible risk reduction – lower chronic disease utilization, decreased accident severity, faster return-to-work, and measurable declines in the key post-COVID morbidity drivers.

- Emotional: Authentic resonance through merit-based recognition, constructive challenge, and mission alignment. This builds voluntary engagement and retention rather than dependency or resentment.

The outcome is multiplied Created Value. Higher productivity. Lower absence and presenteeism. More stable staffing. Reduced indirect costs (customer service disruptions, safety incidents, operational delays). The “garden” becomes self-reinforcing. Resilient People produce sustainable fruit cycle after cycle.

Next week, in Part 2, we’ll examine how trucking organizations are applying these same principles to address driver health, shortages, and safety risks. Companion to ICSL’s focused analysis.

Take the First Step

As a starting point, contact Humaculture® for a review of your medical, disability, workers’ compensation, and absenteeism data, mapped to the Dynamic Matrix. We’ll identify leverage points to cultivate resilience and Created Value in your unique terrain.

Read the companion ICSL article for the full diagnostic of 2025 trends. Join us in building organizations where People don’t just manage chronic risk. They flourish despite it.

Humaculture® — Cultivate Organizations, Grow People.

LinkedIn: humacultureinc

Introducing Our New Series: Cultivating Resilience Amid Rising Chronic Health Conditions

Above Image: Focused on Resilience.

January 22, 2026

By Humaculture, Inc.

The pressures are unrelenting. Rising chronic health conditions drive escalating costs. Medical claims. Disability durations. Workforce disruptions. Operational strain.

ICSL has launched a powerful 5-part series diagnosing these post-pandemic realities across insurance, employer benefits, and high-risk industries like trucking.

We at Humaculture® are proud to publish a companion series. We focus on the organizational path forward. Cultivating resilient “soil” (Structure, Assets, Processes) so People thrive and produce sustainable Created Value.

Our articles publish every Thursday.

Here is the full lineup:

- Rising Chronic Health Conditions Costs: Feeding Organizational “Soil” to Build Sustainable Resilience (Live now – companion to ICSL’s insurance crisis analysis.)

- Chronic Health Risks in High-Variability Operations: Cultivating “Soil” Resilience in Trucking and Beyond (Live now – companion to ICSL’s Trucking Industry Health Crisis.)

- Chronic Condition Surges and Workforce Impacts: Enriching Organizational “Soil” for Population Resilience (Live now – companion to “Real Employer Impacts – Post-COVID Disability and Cost Surges“)

- Beyond Pharmacology Alone: Integrative “Soil” Cultivation for Lasting Chronic Condition Mitigation (Live now – companion to “Why GLP-1 Drugs Alone Aren’t Enough – The Case for Integrative Solutions“)

- Partnering to Address Chronic Risk at Scale: Aligning Forward-Living Protocols with Organizational “Soil” Health (Thursday, March 5)

ICSL provides the clinical and industry diagnosis. Humaculture® delivers the framework to turn insight into action. Balanced outcomes across the Three Promises. Economic viability through reduced costs. Effectual risk reduction. Emotional resonance that builds engagement.

Leaders in insurance, benefits, transportation, and operations—this series is for you.

Follow us on X @HumacultureInc. and LinkedIn. Share with colleagues facing these challenges.

Ready to explore how the Humaculture Topological Model applies at your Organization? Contact us for a review of your Organization or program performance.

Read Part 1 today. Join us Thursdays.

Steve Cyboran – [email protected]

Wes Rogers – [email protected]

Caroline Cyboran – [email protected]

#ChronicHealth #OrganizationalResilience #Humaculture #HARS™ #CreatedValue

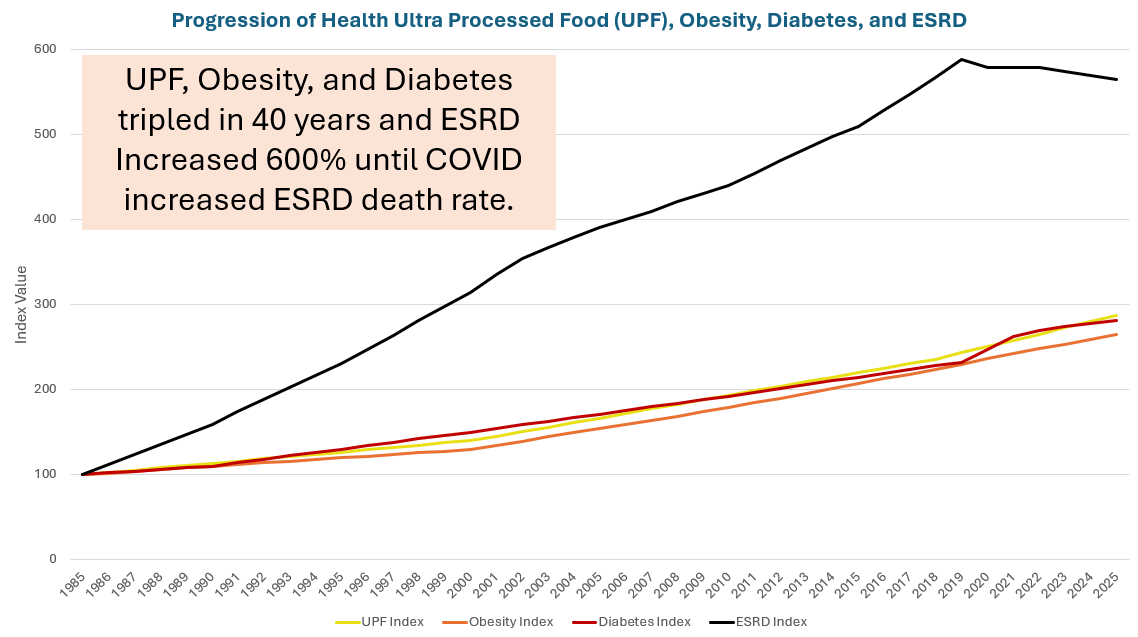

Trends in Diabetes and Excess Mortality – CEO Interview

Read about Humaculture’s CEO’s, Steve Cyboran, ASA, MAAA, FCA, CEBS, interview with Life Annuity Specialist featured in Diabetes is Killing More Americans Than Ever Before. Steve explains the trends in diabetes over the last 40 years. The rate of diabetes almost quadrupled from around 3% in the 1980s to 11.3% in 2023. Deteriorating health is a contributing factor to the trends in diabetes, which leads to elevated health costs, disability rates, and mortality.

The good news is that there is quite a bit insurance carriers and employers can do to stem the tide and help People become healthier to the benefit of the insured and the Organization’s bottom line. Contact us to discuss how.

Available Support

We are available to support you in your strategy, design, compliance, financial, and monitoring needs. Our team includes business and human relations leaders, finance experts, actuaries, clinicians, behavioral health experts, pharmacy experts, and legal resources to guide you through the strategy and compliance process. Please contact us: [email protected].

Voluntary benefits & captives: A new paradigm of transparency & control

Join us on Thursday, March 28 from 1:00 to 1:30 CDT for Employee Benefit News’ Web Seminar “Voluntary benefits & captives: A new paradigm of transparency & control.”

Presenters

- Steve Cyboran, ASA, MAAA, FCA, CEBS, actuary and strategy consultant

- Amy Hollis, CEO/Founder at Employees First

- Erik Sossa

- Mimi Leonard

- Allison Itami, Principal at Groom Law Group

Objective

Today, employers face increasing pressure to reduce costs while increasing the value of Total Rewards in an effort to elevate employees’ wellbeing. In this ever-challenging benefits landscape, there is a ground breaking innovation – the pairing of voluntary benefits with captives. This new approach offers exciting solutions, particularly for large-market employers, but first, but it is critical to understand and evaluate the potential opportunities and pitfalls.

Hear from industry leading benefits experts to learn more about…

- the market forces driving these emerging solutions

- the foundational basics – why deliver voluntary benefits through a captive?

- the best practices for evaluating whether these solutions are a “fit” for your organization

- expectations for the future

- why you may not have heard about these solutions until now

Houston Business Coalition on Health Conference Presents The Value of Alternative Medical Facility Healthcare

Join the Houston Business Coalition on Health (HBCH) for its annual meeting where HBCH will be outlining the value of alternative medical facility healthcare. Our CEO, Steve Cyboran, ASA, MAAA, FCA, CEBS will be facilitating a session during the meeting.

Panel topics include:

- Independent Primary Care Clinics

- Onsite / Near Site Clinics

- Retail Clinics

- Ambulatory Surgical Centers

- Free Standing Imaging Centers

- Free Standing Specialty Infusion Centers

- Community Oncology Clinics

- Home Health Care

- Digital / Telemedicine

Event Info

Breakfast and Lunch: Included

Time: August 24, 2023 7:00 AM – 7:00 PM (CDT)

Location: 6500 Main St, Houston, TX, 77030, United States (Rice University – Bioscience Research Collaborative Building)

HBCH Employer Member: $50

Employer Non-Member: $75

HBCH Associate Member: $100

Associate Non-Member: $350

Event Link: https://coalition.houstonbch.org/ap/Events/Register/MrD6wGoP

LinkedIn: https://www.linkedin.com/company/houston-business-coalition-on-health/

Houston Business Coalition on Health Presents Houston Smart Network

Join the Houston Business Coalition on Health for this employer-only event (consultants may come with their client) where HBCH will be outlining the concept, timeline, and benefits for participating in the Houston Smart Network. Our CEO, Steve Cyboran, ASA, MAAA, FCA, CEBS will presenting during the meeting.

Lunch will be served!

HBCH is on the cusp of developing a Houston-based alternative to your regular health plan that provides more for less. HBCH will highlight Smart Network benefits, including better health outcomes, less cost for you and your employees, and an integrated, simple employee experience.

This interactive discussion will include:

- The urgent need for a Smart Network in Houston

- Overview of the Smart Network – a different but proven type of benefits option

- Smart Network Design Elements

- Actuarial Analysis of the Smart Network

- Local and National Provider Assessments

- How to Get Started

Presenters

- Steve Cyboran, ASA, MAAA, FCA, CEBS, CEO, Consulting Actuary, Chief Behavioral Officer, Humaculture, Inc.

- Chris Skisak, PhD, Executive Director, HBCH

- Dan Burke, VP Corporate Benefits, Turner Industries Group, LLC

- Sue Prochazka, Benefits Consultant, HBCH

- Josh Berlin, CEO, rule of three

- Ken Janda, CEO, Wild Blue Health Solutions

- Daniel Crowe, MD, Wild Blue Health Solutions

- Juliet Breeze, MD, CEO, Next Level Medical

- Cheryl DeMars, President & CEO, The Alliance

Objective

Explain the benefits of the Houston Smart Network, understand employer interests, including willingness to support financially, and learn about new Texas legislation that will be gamechanger for employers. Interested employers can contribute to the development of the Houston Smart Network, and each dollar may be matched by two major philanthropic organizations.

Event Info

Fee: Free!

Lunch: Included

Time: Tuesday, June 6, 2023 12:00 PM – 4:00 PM (CDT)

Location: 50 Waugh Drive, Houston, 77007 (United Way of Greater Houston)

Event Link: https://houstonbch.org/smart-network-overview/

Watch CEO’s Presentation on Strategies to Reduce Total Cost of Care

Watch a replay of our CEO, Steve Cyboran, ASA, MAAA, FCA, CEBS, present at the Houston Business Coalition on Health on How to Reduce Total Cost of Care Through Organizational Culture. Joining him as a presenter is Ray Fabius, MD, Co-Founder and President of HealthNEXT.

Available Support

We are available to support you in your strategy, design, compliance, financial, and monitoring needs. Our team includes business and human relations leaders, finance experts, actuaries, clinicians, behavioral health experts, pharmacy experts, and legal resources to guide you through the strategy and compliance process. Please contact us: [email protected].